Resources for Exporters and Importers

U.S. federal trade policy influences how Maine businesses are able to import, manufacture, and export goods and services. While tools such as Free Trade Agreements promote trade between countries, tariffs and non-tariff barriers often increase the cost of trade.

The rules of international trade change; however, our role remains the same. For over 25 years, MITC has helped Maine businesses succeed in global markets. Our team is here to help Maine businesses navigate the changes ahead.

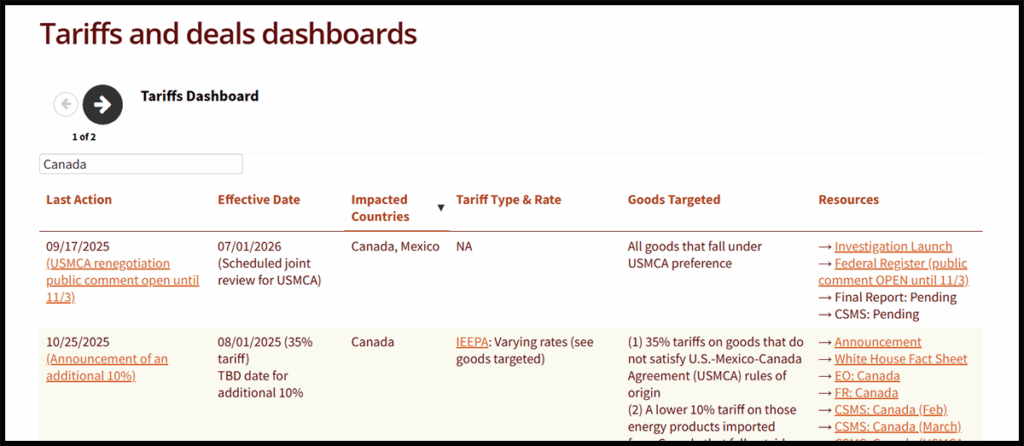

Tariffs

A tariff is a tax on imported goods and materials. Tariffs are intended to protect domestic industries by making foreign products more expensive or generate revenue for the federal government.

Typically, extra costs of tariffs get passed along to customers in the form of higher prices. When other countries retaliate with tariffs of their own on U.S. exports, the impact on prices is compounded. For small manufacturers that rely on imported products and materials, these tariffs could mean a significant increase in costs of production, reducing competitiveness domestically and internationally.

Tariff Rate Resources

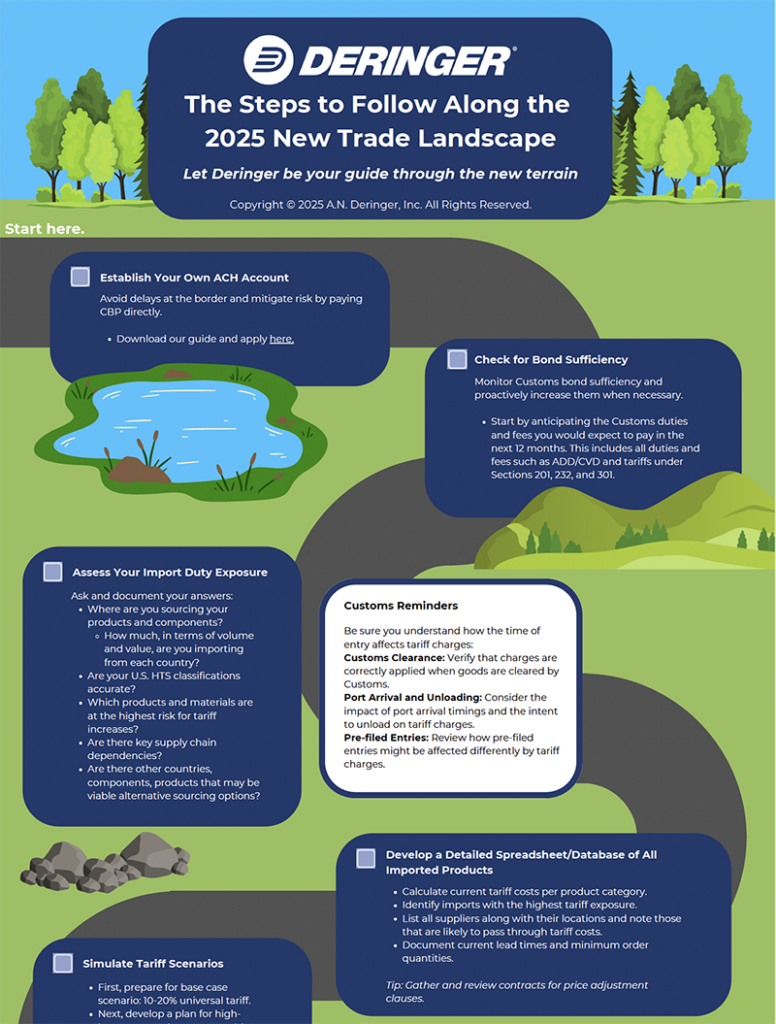

Trade Resilience Strategies

Information provided here is for educational purposes. We recommend that you engage with an expert to ensure compliance with all U.S. Customs regulations. In attempts to minimize tariff liability, it’s crucial to avoid duty evasion. MITC can provide referrals to assist with your specific concerns and questions.

Considerations for Exporters and Importers

Engage with a Trade Expert

Whether a MITC Trade Specialist, a Licensed Customs Broker, or a consultant, a trade expert can help guide you to the right resources and make suggestions depending on your unique business situation. Often, tariff applicability questions involve legal, financial, and logistical considerations that are unique to your business and supply chain. Likewise, tariff mitigation strategies will vary based on certain factors such as their legal basis.

Confirm Product/Component Classifications

Properly classifying products through the Harmonized Tariff Schedule (HTS) is key to ensuring compliance with international trade laws, accurate duty calculation, and efficient customs clearance, reducing legal and financial risks.

Determine Duty Payment Method

Applying for and obtaining an ACH account enables direct payments of duties to U.S. Customs. If you have a Customs Broker or logistics firm, they can help you set this up online. If you have an import bond, ensure that it is sufficient to prevent bond saturation due to increased import fees.

Invest in Supply Chain Agility

Assessing supply chain exposure and documenting all imported products is good practice in a rapidly evolving trade environment. Import or export order lead time and each product’s country of origin are key to consider.

Diversifying the supply chain allows operations to become resilient to changes and can offer cost benefits as well. Maine companies have access to a national Supplier Scouting program through the Maine Manufacturing Extension Partnership (MEP). This free service provides domestic supply chain options for companies seeking additional suppliers. Maine MEP Contacts: Mariah Cunningham-Knaus and Daniel Pavitt

Import Tariffs: Deferral and Mitigation

Duty Drawback

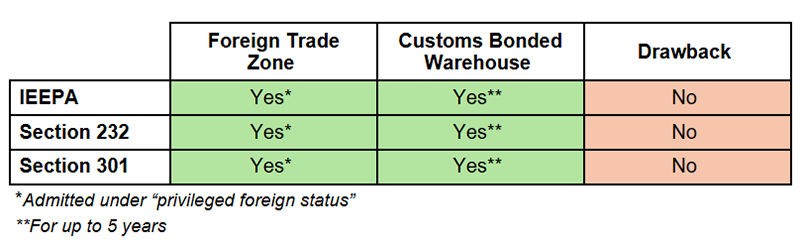

A duty drawback – or “drawback” as referred to by U.S. Customs and Border Protection (CBP) – is a refund process where certain duties, internal revenue taxes, and fees collected at the time of importation are reimbursed if the goods are exported or destroyed. Importers can file a claim jointly with an exporter to receive benefits. Note that IEEPA tariffs, Section 232 tariffs, and certain other tariffs are not eligible for drawbacks. See Claim Filing FAQ or contact CBP for Questions.

Stockpiling

Stockpiling refers to buying and holding extra inventory. By purchasing and storing inventory before tariffs take effect, companies may be able to mitigate the immediate impact of the tariffs. While this strategy buys time and can provide flexibility to adjust to changing market conditions, offer competitive advantages by keeping prices stable, and mitigate risks associated with supply chain disruptions and price volatility, it comes with challenges like storage costs and may not be viable for companies struggling with cash flow.

Exemption Process

Companies can apply through the Office of the U.S. Trade Representative (USTR) or the U.S. Department of Commerce for an exclusion for a specific tariff. The USTR established an exclusion process for each stage of tariff increases, allowing stakeholders to request exemptions for U.S. imports that would otherwise be subject to tariffs. It is important to note that most of the exclusion applications have been denied by the USTR.

Additional Deferral Strategies

ForeignTrade Zone (FTZ)

Foreign Trade Zones are economically advantageous for importing and re-exporting goods. Under zone procedures, the usual formal U.S. Customs and Border Protection entry procedures and payments of duties are not required on the foreign merchandise unless and until it enters CBP territory for domestic consumption.

Maine FTZs:

Bangor #58 Counties served: Hancock, Penobscot, Piscataquis, Waldo and Washington

Waterville #186 Counties served: Lincoln, Cumberland, Sagadahoc, Androscoggin, Kennebec, Waldo, Knox, York and Somerset (partial)

Customs Bonded Warehouse

A Customs Bonded Warehouse is a secured area within U.S. customs territory, where imported goods can be stored without duty payment for up to five years. The goods can be repackaged, sorted, or labeled under the supervision of U.S. customs officials. The duty would then be paid prior to releasing the goods, but at the rate in effect at the time of withdrawal.

Can certain tariffed goods under legal basis still be used for deferral/drawbacks?

MITC Members with Logistics Expertise

A customs broker focused on trade compliance services, logistics, and freight solutions for your import – export needs

Provides time-sensitive, flexible transportation services for heavyweight freight of any size to anywhere in the world

Provides timely and economical cargo transportation and specialized export and import customs services

Offers door-to-door logistics solutions that connect continents efficiently and quickly through a global network of contacts

International logistics, trade compliance expertise, domestic shipping, and streamlined supply chain solutions

Sets the standard for efficiency, flexibility, and integration of your total supply chain needs

International shipping and forwarding company, specializing in logistics around the North Atlantic Ocean and beyond

Region’s largest independent freight forwarder and customs broker offering international logistics and trade consulting

A group of integrated companies with a focus on logistics, providing truckload freight hauling, warehousing, final mile delivery, and more